Download Your FREE Printable 1098 Form NOW Before It’s Too Late!

Meta Title: Get Your FREE 1098 Form Now!

Meta Description: Need your 1098 form? Learn how to download your FREE printable 1098 form for mortgage interest deductions, understand deadlines, and avoid common mistakes.

Introduction:

Tax season can be a stressful time, and understanding the necessary forms is crucial for a smooth filing process. One of the most common tax forms related to homeownership is the 1098 form, also known as the Mortgage Interest Statement. This form provides essential information for homeowners to potentially claim mortgage interest deductions on their federal income tax return. This article will guide you through everything you need to know about the 1098 form, including how to download your FREE printable 1098 form, understand its purpose, and navigate the complexities of tax filing. Don’t delay – understanding this information and getting your form can save you money and time!

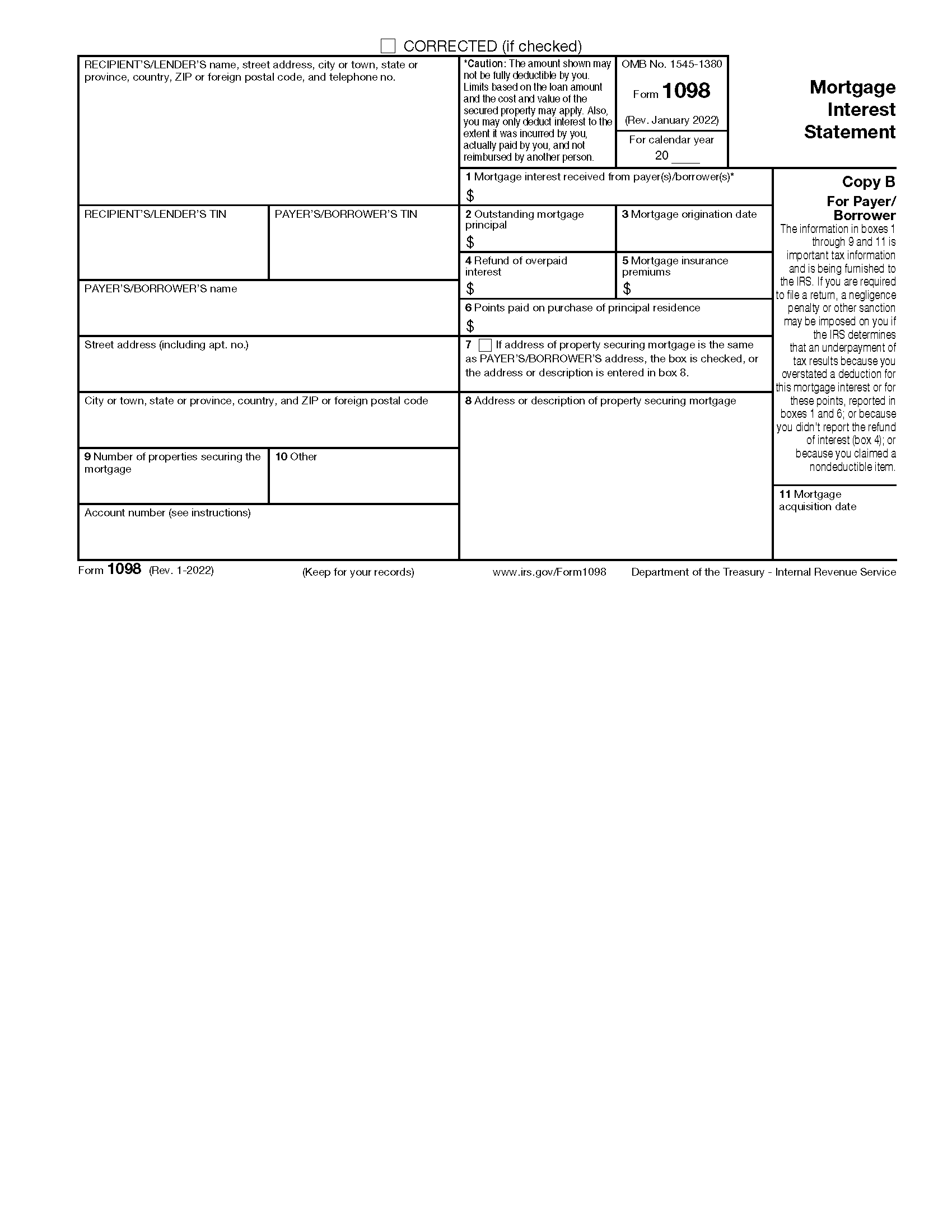

Understanding the 1098 Form: What Is It?

The 1098 form is a crucial document for homeowners who pay mortgage interest. It’s a statement provided by your mortgage lender (e.g., bank, credit union, or other financial institution) that details the interest you paid on your mortgage during the tax year. This information is vital for determining if you can deduct mortgage interest on your federal income tax return, potentially lowering your tax liability.

- Key Information on Form 1098:

- Your name and address.

- Your lender’s name and address.

- The mortgage interest you paid during the tax year (Box 1).

- The outstanding mortgage principal (Box 2).

- Points paid on the mortgage (Box 6).

- Other potentially deductible items.

Source: Internal Revenue Service (IRS) - Instructions for Form 1098 (Replace with the most current year’s instructions)

Who Receives a 1098 Form?

Generally, if you paid $600 or more in mortgage interest during the tax year to a single lender, that lender is required to send you a 1098 form. Even if you think you haven’t paid that much interest, it’s always best to check with your lender. You should receive your 1098 form by January 31st of the following year. For example, if you need the form for the 2023 tax year, you should receive it by January 31, 2024.

How to Download Your FREE Printable 1098 Form

While your lender is obligated to send you a 1098 form, you can often download your FREE printable 1098 form directly from your lender’s website. Here’s a general guide:

- Access Your Lender’s Website: Log in to your online account with your mortgage lender.

- Navigate to Tax Documents or Forms: Look for a section labeled “Tax Documents,” “Tax Forms,” or something similar. This is often located in the “Documents,” “Statements,” or “Account Management” area.

- Select the Tax Year: Choose the appropriate tax year for which you need the form (e.g., 2023).

- Download the Form: Locate the 1098 form and select the option to download your FREE printable 1098 form. It will usually be available in PDF format, which you can then print.

- Contact Your Lender: If you can’t find it online, contact your lender’s customer service department to request a copy.

Important Note: While you can often download a digital copy, it’s important to keep the original document or a printed copy for your records.

What If You Don’t Receive Your 1098 Form?

If you haven’t received your 1098 form by mid-February, contact your lender immediately. Delays can happen, and you don’t want to miss out on potential tax deductions.

- Tips for contacting your lender:

- Have your loan number and social security number ready.

- Confirm your mailing address with the lender.

- Ask if the form has been sent and, if so, when it was mailed.

- If the form hasn’t been sent, request that they send you another copy immediately.

Using the 1098 Form for Tax Deductions

The information on your 1098 form is used to calculate your mortgage interest deduction. You can deduct the amount of mortgage interest you paid during the year, subject to certain limitations based on the amount of your mortgage and whether you itemize deductions.

- Important Considerations:

- Itemizing vs. Standard Deduction: You can only deduct mortgage interest if you itemize deductions on Schedule A of Form 1040. If the standard deduction is higher than your itemized deductions (which includes mortgage interest, state and local taxes, etc.), you won’t benefit from the mortgage interest deduction.

- Mortgage Limits: The amount of mortgage interest you can deduct is limited based on when you took out your mortgage and the amount of the loan. Generally, interest on up to $750,000 of mortgage debt (for married filing jointly) is deductible for mortgages taken out after December 15, 2017.

- Home Equity Loans: Interest paid on home equity loans is deductible only if the loan proceeds were used to buy, build, or substantially improve your home.

Consult a Tax Professional: Due to the complexities of tax laws, it’s always recommended to consult with a qualified tax professional or use tax preparation software to accurately calculate your deductions.

Common Mistakes to Avoid

- Ignoring the Form: Failing to obtain and use your 1098 form can mean missing out on significant tax savings.

- Using the Wrong Form: Make sure you’re using the 1098 form for the correct tax year.

- Incorrect Information: Double-check the information on the form against your records to ensure accuracy.

- Failing to Itemize: Forgetting to itemize deductions on Schedule A means you won’t be able to claim the mortgage interest deduction.

Where to Find Additional Help

- IRS Website: The IRS website (IRS.gov) provides comprehensive information on taxes, including instructions for Form 1098 and other relevant publications. (Internal Revenue Service)

- Tax Professionals: Consult a tax professional (Certified Public Accountant (CPA) or Enrolled Agent (EA)) for personalized advice and assistance.

- Tax Preparation Software: Use reputable tax preparation software that guides you through the process and helps you accurately calculate your deductions.

Conclusion: Don’t Delay – Get Your 1098 Form Now!

Understanding the 1098 form and knowing how to download your FREE printable 1098 form are crucial steps in preparing your taxes if you’re a homeowner. By following the steps outlined in this guide, you can ensure you have the necessary documentation to claim potential mortgage interest deductions and minimize your tax liability. Remember to act promptly, contact your lender if needed, and consult with a tax professional if you have any questions. Take control of your finances and get your form today!